RainbowLab

RainbowLab RainbowLab

RainbowLab

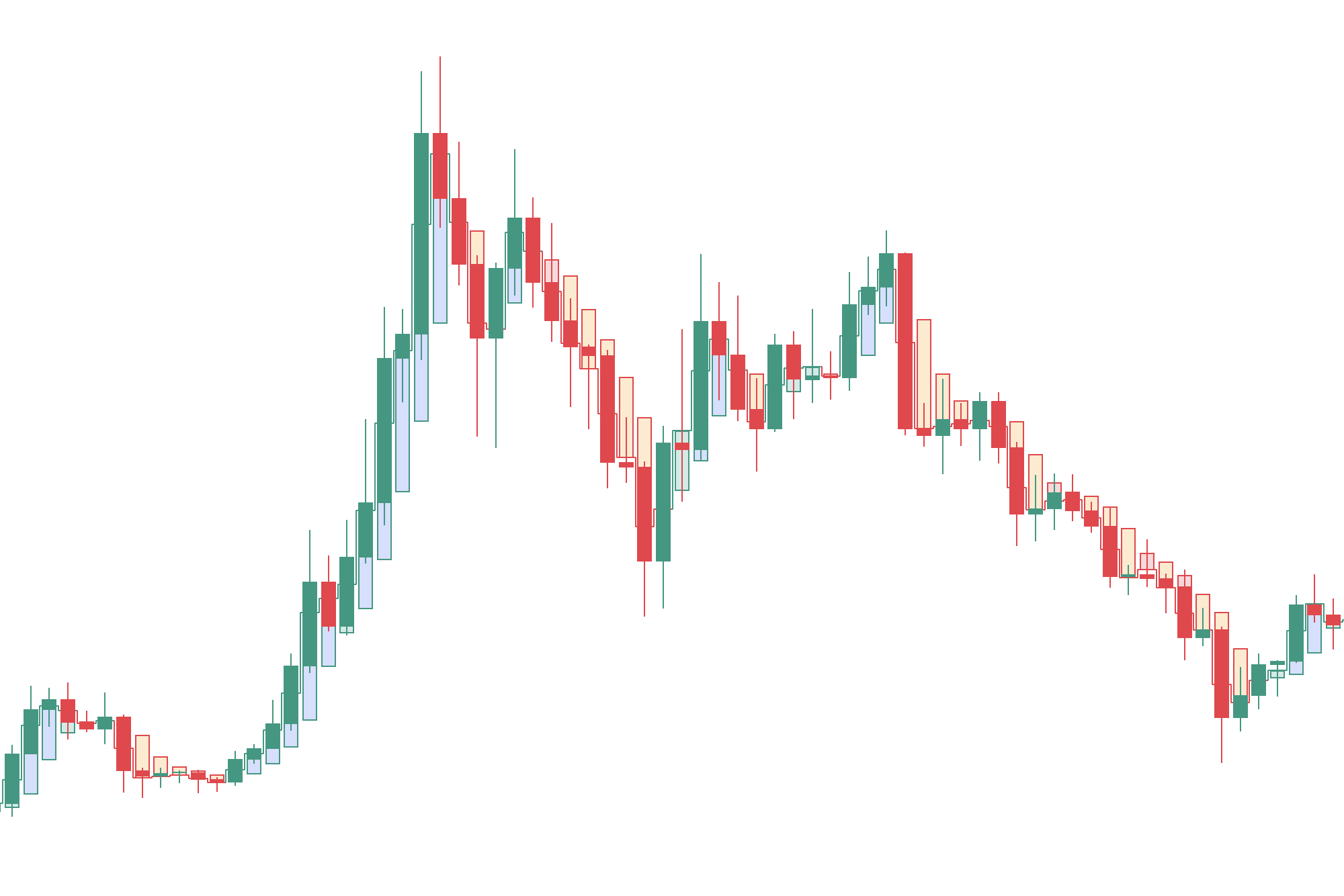

The Heikin Ashi Overlay indicator offers a colourful and customisable way to represent Heikin Ashi related information on your chart. Enjoy the power of the Heikin Ashi indicator while keeping your chart tidy and clear. It is definitely a must-have for clutter-free chart lovers.

Heikin Ashi, which translates to “average bar” in Japanese, is designed to filter out market noise and present a clearer picture of price trends. It achieves this by averaging open, close, high, and low prices of the previous candle to determine the values for the current candle.

This script employs Heikin Ashi calculations and enables to display the related information in various formats, not solely as candles. Moreover, by functioning as an overlay, this script allows you to combine the strengths of different bar styles. Find the combination that fits your strategy: Heikin Ashi + Japanese candlesticks, Heikin Ashi + bars, Heikin Ashi + line, and more.

As mentioned above, Heikin Ashi charts are mainly used to identify trends and their strength, as well as filtering noise out. Traders can use them to identify trends and potential trend reversals more clearly than traditional candlestick charts. The smoothed candles make it easier to recognise the direction of the market and potential shifts in sentiment. The Heikin Ashi candlesticks have distinct patterns that can signal potential changes in market behavior. Traders often look for specific patterns, such as Doji or trend continuation patterns, to make trading decisions. Also, series of consistent Heikin Ashi candles in the same direction can indicate a strong and sustained trend.

When Heikin Ashi candles change colour, it might suggest an exhaustion of the trend, and there is a risk of a potential price correction/bounce or reversal. In such conditions, there is a higher probability that the asset’s price may start to consolidate or reverse, as it has moved in one direction too quickly or too far in a short period.

The purpose of this indicator is not to reinvent the wheel but to provide an easy way to combine what already exists. Instead of switching back and forth in between different bar styles or having multiple charts of the same asset with a different bar style next to each other, combine them into one. This will allow you to keep your chart tidy and highlights only what matters to you.

When it comes to preferences, everyone has their own. This is why the key concept of this indicator is to be customisable. You are given the ability to only show the information you need but also to have them displayed in various ways. This indicator can be adapted to fit everyone’s needs.

This indicator works for any kind of market: Commodity, Crypto, Forex, Index, Stock.

It acts as an overlay, which means that the indicator adds information on top of the chart.

Once added to the chart, the Heikin Ashi related information will be displayed and clearly identifiable.

Heikin Ashi charts visually represent price movements, emphasising trends and reducing the impact of short-term price fluctuations. This can be particularly useful for traders who want a clearer view of the overall market direction and cancel market noise in a volatile market. It is also interesting for markets having gaps as Heikin Ashi does not have any.

Traders often use Heikin Ashi patterns to generate signals for entering or exiting trades. These unique candlestick patterns can signal potential changes in market sentiment.

Moreover, this script can assist you in identifying key support and resistance levels more effectively.

This indicator can prevent you from chasing a move or a trend which is already overextended. It can also help you enter a new trend at an early stage or re-enter an existing trend after a correction.

This indicator has been created to be used as an overlay but it can also be used on its own, in its dedicated pane.

The Heikin Ashi candles are calculated using a modified formula that involves averaging price data from the previous candle to smooth out fluctuations and emphasise trends. The calculations for each Heikin Ashi candle are as follows:

→ Open : The open price is the average of the previous candle’s open and close.

Open = (Previous Open + Previous Close) / 2

→ Close : The close price is the average of the open, close, high, and low of the current candle.

Close = (Open + Close + High + Low) / 4

→ High : The high is the maximum value of the current candle.

High = Maximum of (High, Open, Close)

→ Low : The low is the minimum value of the current candle.

Low = Minimum of (Low, Open, Close)

An upside candle having the low equal to the open, is considered having no shadow. Alternatively, a downside candle having the high equal to the open, is considered having no shadow. When a candle has no shadow, it emphasise the strength of the direction.

Based on your preferences, the Heikin Ashi information are displayed differently on the chart. You can select a different style for the overlay and choose various options to be displayed.

Traders often create custom indicators or trading systems by combining existing indicators to gain a more comprehensive view of market conditions.

The way in which the indicators are combined and weighted can be a key factor. Traders might give more emphasis to certain indicators based on their historical effectiveness or relevance to specific market conditions. The specific rules or criteria used to identify trends can be unique. For example, a trader might set criteria for simultaneous signals from both Heikin Ashi and Japanese candlesticks to increase the reliability of the signals.

The originality of this script comes from the high level of customisation and the ability to use it as an overlay to keep charts reading clear and concise. Our mantra is to provide highly customisable indicators that allow traders to tailor them to their strategies rather than obliging them to adjust their strategies to fit the indicators they are using. Traders may fine-tune what information of the Heikin Ashi are displayed and which way they are displayed in, to adapt to different market environments.

As mentioned, this indicator only shows Heikin Ashi related information. It is not a strategy in itself. In fact, it is important to note that being in an trend does not guarantee a continuation of it, and markets can correct before starting another trend. Other indicators and techniques should be used alongside, to create a strategy and better identify points of interest in markets.

Because this indicator is based on Heikin Ashi calculations, the same limitations remain, such as delayed signals, reduced accuracy in ranging markets or dependency on previous candle data.

Heikin Ashi calculations are usually used in conjunction with other technical and fundamental analyses to make informed trading decisions.

Multiple aspects of this indicator are customisable.

A global checkbox allows you to quickly show / hide the Heikin Ashi candles. It has the same effect as ticking or unticking at the same time the checkboxes “Body”, “Border” and “Wick”. Be sure to tick this option if you want the Heikin Ashi candles to be displayed.

Additionally, the following elements of the candles can be configured individually:

→ Body

→ Border

→ Wick

By enabling these elements, the candles will be displayed accordingly. When not selected, the corresponding candle’s elements would be hidden.

For each elements, you can attribute two colours, one for the upside and one for the downside.

The overlay type can be changed. The options are:

→ Background : The background is coloured.

→ Candle : The candle is coloured.

→ Cloud : The candle is coloured.

→ Shape : A shape, located on the same offset as the candle, is coloured.

The transparency can be set globally and applied to the whole indicator. If the overlay type is set to “Candle”, the transparency of the candle’s body is overrided by this value.

On top of the regular candles’ elements, some options can be added to the chart. You can choose amongst:

→ Open : Add a line representing the opening of each candle.

→ Close : Add a line representing the closing of each candle.

→ No shadow : Colour differently the candles having no shadow.

The content provided by this indicator is for educational and informational purposes only. This indicator cannot be considered as financial advice.

Historical performance based on this indicator do not guarantee any future result.

Trading is a risky activity and may involve losing money. Refer to a qualified financial advisor to get help and make appropriate financial decisions.

We are happy to provide indicators to the community for free, but we believe the time spent working on them has value. This value reflects our desire to protect our source code.