RainbowLab

RainbowLab RainbowLab

RainbowLab

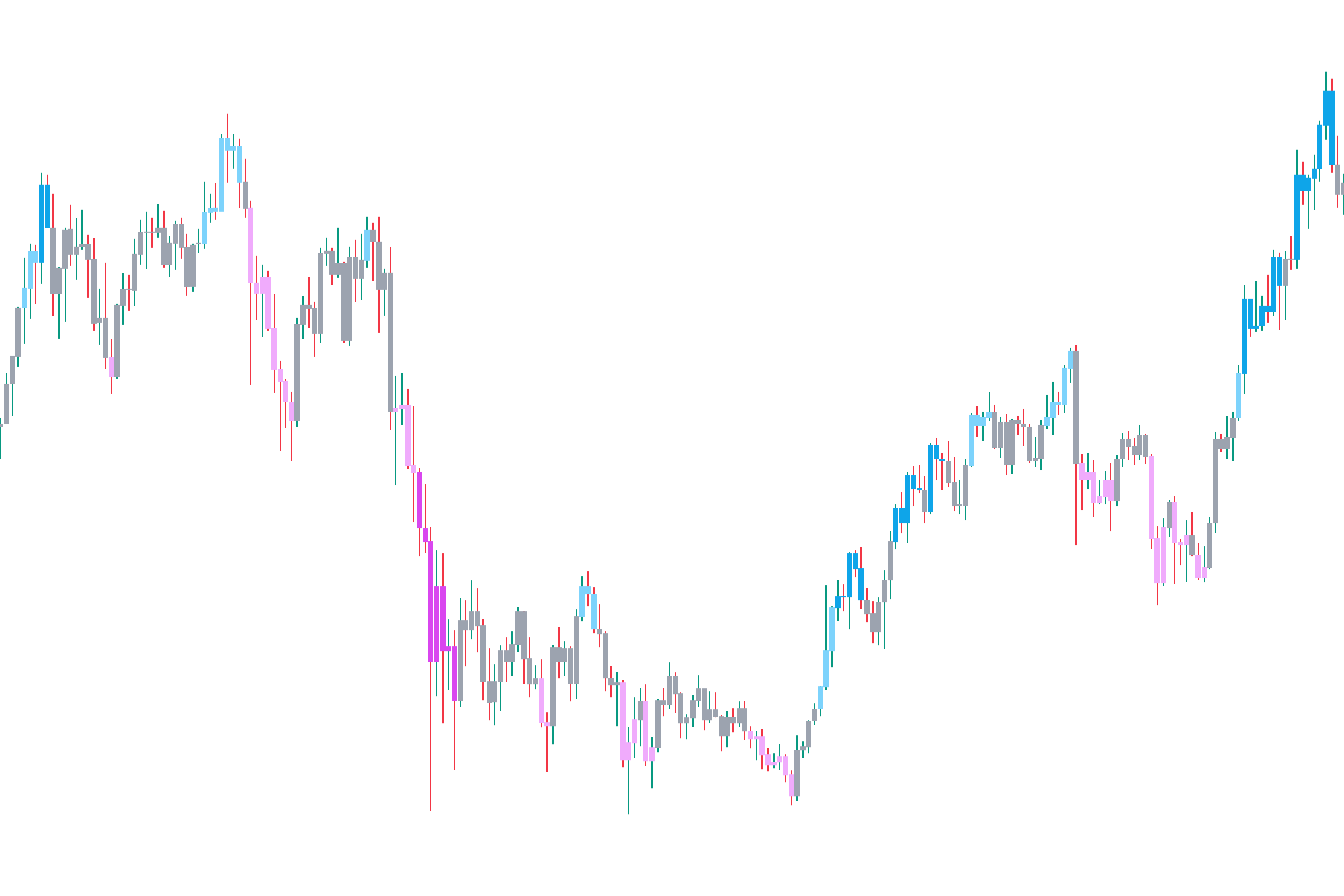

The Combined Overbought Oversold Overlay indicator offers a colourful and customisable way to highlight overbought and oversold areas on a chart. Enjoy the power of your favourite indicators while keeping your chart tidy and clear. It is definitely a must-have for clutter-free chart lovers.

An overbought area refers to a situation where the price of a financial asset, such as a stock, commodity, or currency, has risen to a level that is believed to be too high and unsustainable in the short term. An oversold area is the opposite.

There are different technical indicators to identify overbought and oversold conditions. Some of the most commonly used indicators for this purpose are the Relative Strength Index (RSI), the Commodity Channel Index (CCI), the Bollinger Bands (BB), the Money Flow Index (MFI) and the Williams %R (WPR). Those indicators are integrated into this script and can be used to determine the overbought and oversold areas.

When those indicators pass a certain threshold, it suggests that the asset may be overvalued / undervalued, and there is a risk of a potential price correction / bounce or reversal. In such conditions, there is a higher probability that the asset’s price may start to consolidate or reverse, as it has moved in one direction too quickly or too far in a short period.

In this script, the calculations made to determine if an area is overbought / oversold use those indicators and let you pick the ones you prefer. According to your preferences, you can decide for example to use the RSI alone but not the CCI, or vice-versa. You can also decide to use them both and combine them to filter the overbought / oversold areas even more. The way you combine those indicators together will also have an impact on the result as it would filter out more or less noise on the chart. Indeed, you would receive fewer signals when all indicators must simultaneously indicate overbought / oversold conditions compared to the scenario where a signal is generated if only one of them indicates such conditions.

The purpose of this indicator is not to reinvent the wheel but to provide an easy way to combine what already exists. Instead of adding multiple indicators next to your chart like the RSI or the CCI, this indicator allows you to keep your chart tidy and highlights only what matters to you.

When it comes to preferences, everyone has their own. This is why the key concept of this indicator is to be customisable. By giving the ability to select different indicators and combine them in multiple ways, this indicator can be adapted to fit everyone’s needs.

This indicator works for any kind of market: Commodity, Crypto, Forex, Index, Stock.

It acts as an overlay, which means that the indicator adds information on top of the chart.

Once added to the chart, the overbought and oversold areas will be displayed and clearly identifiable.

Overbought conditions can be used as signals to potentially sell or take profits, as it may indicate that the asset is due for a downward price adjustment. The contrary can be said for oversold conditions.

This indicator can prevent you from chasing a move or a trend which is already overextended. It can also help you enter a new trend at an early stage or re-enter an existing trend after a correction.

Note that this indicator overrides some of the global TradingView settings like the candle’s body colour. This is necessary to display specific colours to overbought / oversold areas. Other global TradingView settings such as the candle’s border colour are not impacted by this indicator and should be changed according to everyone’s preferences. We recommend disabling the candle’s border globally to visualise better the highlights but once again, it is up to you.

Based on your preferences, indicators are combined to determine the state of a candle: Overbought, Neutral or Oversold.

First, those states are calculated for each indicator. When the indicator value reaches a threshold, the state is set accordingly.

Then, once the state is known for each indicator used, the combination between them is calculated to determine the definitive state of a candle. Those calculations are made based on the type of combination selected: And, FILO and Or.

Finally, the states are displayed based on your preference: Background, Candle or Shape.

Traders often create custom indicators or trading systems by combining existing indicators to gain a more comprehensive view of market conditions.

The way in which the indicators are combined and weighted can be a key factor. Traders might give more emphasis to certain indicators based on their historical effectiveness or relevance to specific market conditions. The specific rules or criteria used to identify overbought and oversold conditions can be unique. For example, a trader might set criteria for simultaneous signals from both RSI and CCI to increase the reliability of the overbought / oversold signal.

The originality of this script comes from the high level of customisation and the ability to use it as an overlay to keep charts reading clear and concise. Our mantra is to provide highly customisable indicators that allow traders to tailor them to their strategies rather than obliging them to adjust their strategies to fit the indicators they are using. Traders may fine-tune the periods or settings of each indicator to adapt to different market environments.

As mentioned, this indicator only highlights overbought / oversold areas. It is not a strategy in itself. In fact, it is important to note that being in an overbought / oversold condition does not guarantee an immediate price decline / raise, and markets can remain overbought / oversold for extended periods during strong bullish / bearish trends. Other indicators and techniques should be used alongside, to create a strategy and better identify points of interest in markets.

Because this indicator colours the candles and does not show the graph associated with the indicators used, it does not allow to spot divergences.

Overbought and oversold signals are usually used in conjunction with other technical and fundamental analyses to make informed trading decisions.

Multiple aspects of this indicator are customisable.

Select the areas you want to be highlighted:

→ Overbought

→ Neutral

→ Oversold

By selecting those options, the script will highlight the corresponding areas accordingly. When not selected, the areas would be considered neutral.

For each of those areas, you can attribute a colour. For the overbought / oversold ones, two colours can be picked instead of just one. Those colours are used in the FILO and Or combination modes, to distinguish when markets are in extreme overbought / oversold conditions.

The overlay type can be changed. The options are:

→ Background : The background is coloured.

→ Candle : The candle is coloured.

→ Shape : A shape, located on the same offset as the candle, is coloured.

The transparency can be set globally and applied to the whole indicator.

The indicators used to determine an overbought / oversold area can be selected individually. You can choose amongst:

→ Bollinger Bands

→ Commodity Channel Index

→ Money Flow Index

→ Relative Strength Index

→ Williams %R

The way those indicators are combined together can be customised too. The options are:

→ And : All the indicators selected must be in overbought / oversold condition.

→ FILO (First In, Last Out) : From the first overbought / oversold condition given by a selected indicator to the last one.

→ Or : At least one of the indicators selected must be in overbought / oversold condition.

Additionally, the parameters used to calculate each indicator can be customised. Depending on the indicator, here are the parameters you can customise:

→ Source

→ Length

→ Moving Average type

→ Standard deviation

→ Overbought level

→ Oversold level

The content provided by this indicator is for educational and informational purposes only. This indicator cannot be considered as financial advice.

Historical performance based on this indicator do not guarantee any future result.

Trading is a risky activity and may involve losing money. Refer to a qualified financial advisor to get help and make appropriate financial decisions.

We are happy to provide indicators to the community for free, but we believe the time spent working on them has value. This value reflects our desire to protect our source code.